Denis Doulgeropoulos

Your Financial Professional & Insurance Agent

Should You Speed Up Your Retirement Plans?

According to a March 2021 survey, an estimated 2.8 million Americans aged 55 and older decided to file for Social Security benefits sooner than they expected due to COVID-19. This was about double the 1.4 million people in the same age group who said they expected to work longer, presumably due to pandemic-related financial losses.1

Several older workers were forced into retirement after losing their jobs, and others may have had health concerns. Yet, many people reexamined their retirement plans and priorities as a result of work-related stress and the pandemic’s emotional impact.

Would you be able to retire early if you could afford it? First and foremost, determine whether your income will be sufficient to support the lifestyle you envision. To cover your living expenses, you may have to start draining your life savings instead of accumulating assets. Consider these four factors carefully.

Lost Income and Savings

Your retirement accounts and future earnings could be sacrificed. A retiree making $80,000 a year would lose about $400,000 in salary over the next five years or $800,000 over the next decade, not counting cost-of-living and merit increases. When annual raises averaging only 3% are included, the total rises to nearly $1 million.

Similarly, if the same retiree contributed 5% of salary to an employer-sponsored retirement plan with a 100% match, he or she would have missed out on $8,000 in contributions in the first year, more than $40,000 over five years, and almost $100,000 over 10 years.

Debt and Other Financial Responsibilities

You may not be ready to retire if you are still paying a mortgage, have other debts, or are supporting children or aging parents. It’s ideal to be free of “extra” financial responsibilities so you can focus on meeting your own living expenses without a regular paycheck.

Reduced Social Security Benefits

You can apply for Social Security as early as age 62, but your benefit will be reduced to 70% or 75% of your full retirement benefit for the rest of your life. Even if you do decide to retire, you might want to delay claiming your benefits until you reach full retirement age (66 or 67, depending on the year you were born) or longer if you have sufficient income and/or savings to cover your expenses. As you wait past your full retirement age, your benefits will increase by 8% (up to age 70).

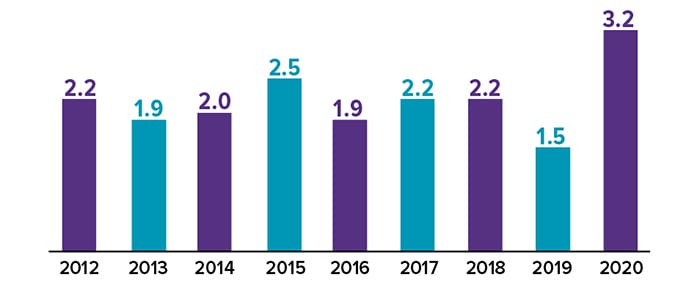

Annual increase in the number of retired baby boomers (in millions)

Higher Medical Costs

If you retire before you (or a spouse) become eligible for Medicare at age 65, you could lose access to an affordable employer-provided health plan. You can purchase health insurance through the Health Insurance Marketplace or a broker, but the age-based premiums are more expensive for older applicants. For two 60-year-olds with a household income of $100,000, the average premium for a silver Marketplace plan in 2021 is $708 per month ($8,500 per year), after subsidies. And if you seek medical treatment, you’ll typically need to cover copays, deductibles, coinsurance, and some other expenses (up to the plan’s out-of-pocket maximum).2

Even with Medicare, it’s estimated that a married couple who retired at age 65 in 2020, with median expenses for prescription drugs, would need $270,000 to have a 90% chance of paying their health-care costs throughout retirement.3

The bottom line is that some people might be giving up more than they realize when they retire early. Before you say goodbye to the working world, be sure you have the resources to carry you through the next phase of your life.

1) U.S. Census Bureau, 2021

2) Kaiser Family Foundation, 2021

3) Employee Benefit Research Institute, 2020

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2021 Broadridge Financial Solutions, Inc.