Denis Doulgeropoulos

Your Financial Professional & Insurance Agent

Is Your Business Eligible for the Research and Development Tax Credit?

Has your business encountered and solved technological challenges in recent years? Maybe you invested in software development, re-engineered manufacturing processes, or performed laboratory testing. If so, your business may be eligible for the federal research and development (R&D) tax credit. This credit may be available to U.S. businesses that spent money to develop new products or improve the performance, functionality, reliability, or quality of existing products or trade processes — whether the work was done by employees or a third-party contractor.

Section 41 of the Internal Revenue Code lays out the rules and regulations for the R&D tax credit. The Protecting Americans from Tax Hikes (PATH) Act of 2015 made the credit permanent and broadened its scope to include many small to midsize businesses.

Generally, the R&D tax credit is a nonrefundable amount that taxpayers can subtract from their federal taxable income. Typically, 6% to 8% of a company’s annual qualifying R&D expenses may be applied against the company’s federal tax liability. If your available tax credit exceeds your tax liability, you can carry your credit forward for up to 20 years. In some instances, the R&D tax credit may be used to offset the alternative minimum tax, while in other instances qualifying new businesses may be able to apply up to $250,000 of their R&D tax credit to their payroll tax liability.

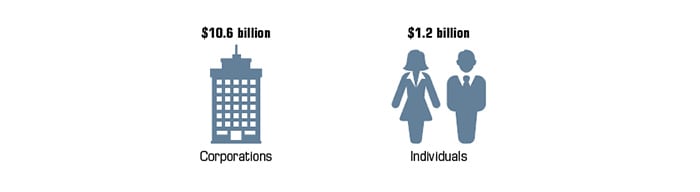

Estimated Savings from R&D Tax Credit in 2020

Four-Part Test

The credit is a percentage of qualified research expenses above a base amount established by the Internal Revenue Service in a four-part test:

• Elimination of uncertainty. The purpose of the research must be intended to eliminate uncertainty relative to the development or improvement of a product or process.

• Process of experimentation. The research must include experimentation or systematic trial-and-error to overcome technical uncertainties.

• Technological in nature. The research must rely on hard sciences such as engineering, physics, and chemistry; or the life, biological, or computer sciences.

• Qualified purpose. The research or activity must be aimed at creating a new or improved product or process, resulting in increased functionality, quality, reliability, or performance of a business component.

A tax professional can help you determine if your business is eligible for this potentially lucrative tax benefit. If you do claim the tax credit, be prepared to document and support any qualifying R&D activities.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2021 Broadridge Financial Solutions, Inc.